What is the difference between Chapters 7 & 13?

Louisiana Bankruptcy

No one plans for financial problems and bankruptcy. It’s a common issue that affects people from all walks of life. Income loss, medical issues, divorce, business failure, and even bad financial decisions can lead to unmanageable debt. We are here to challenge the wrongful stigma surrounding bankruptcy and help you see how it can offer a renewed lease on life.

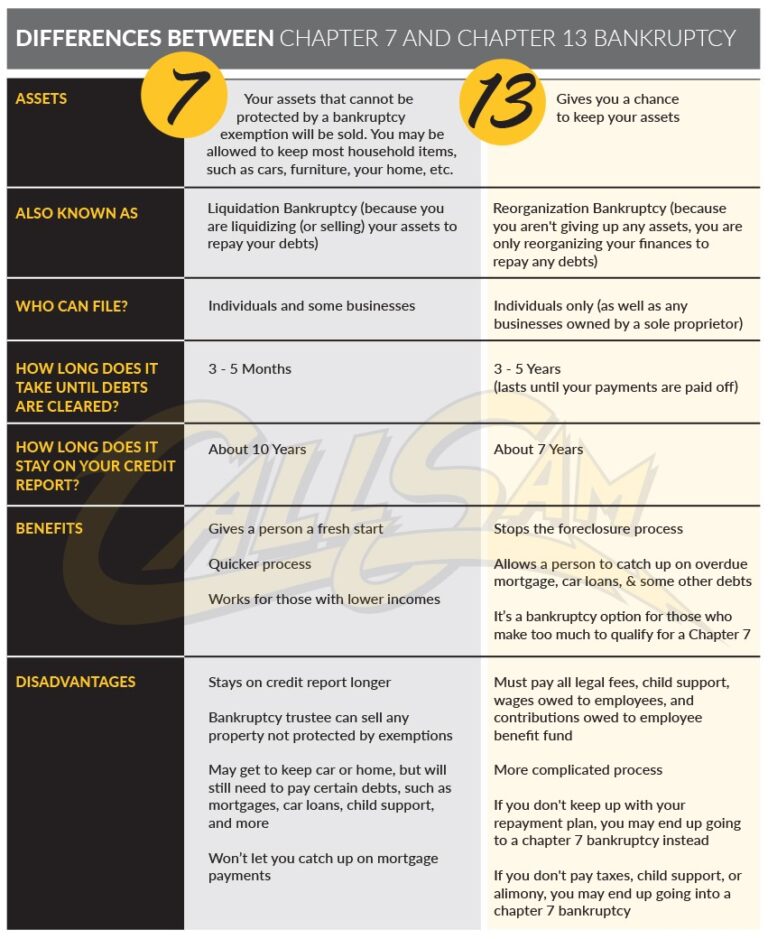

Chapter 7 Bankruptcy

- Commonly known as “liquidation” bankruptcy.

- It involves the sale of the debtor’s non-exempt assets to pay off creditors.

- The debtor’s eligible debts can be discharged, meaning they are no longer legally responsible for repayment.

- Chapter 7 is typically a quicker process, usually taking around three to six months to complete

Chapter 13 Bankruptcy

- Referred to as “reorganization” bankruptcy or a “wage earner’s plan.”

- In Chapter 13, the debtor creates a repayment plan to pay off all or a portion of their debts over three to five years.

- Debtors are allowed to keep their assets and repay their debts through an approved plan.

- Chapter 13 bankruptcy allows debtors to catch up on missed mortgage or car loan payments and stop foreclosure or repossession.

- This type of bankruptcy is primarily designed for individuals with a regular income.

In summary, Chapter 7 bankruptcy offers a fresh start by liquidating assets and discharging eligible debts, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over a period of time, allowing the debtor to keep their assets and catch up on missed payments. The choice between the two types will depend on an individual’s specific financial circumstances and goals. It is recommended to consult with a bankruptcy attorney for guidance on the best option for your situation.